About DEAS Asset Management

A strong strategic partner

With 100+ real estate professionals DEAS Asset Management is a leading investment and asset management company in the Nordics.

With a proven track record of delivering strong returns in all key market sectors, our team possesses complementary skills within planning, investment, financing, development and fund and asset management.

Across the Nordics we have more than €7.8bn assets under management and cover 400 properties across four countries.

We are well positioned in both Core, Core+, value add and opportunistic investment strategies.

Our scale and extensive real estate know-how allow us to provide end-to-end solutions to national, Nordic and foreign investors, not to mention funds-of-funds, family offices and high-net-worth individuals.

We adhere to the six principles for responsible investments as a signatory of the United Nations Principles for Responsible Investment.

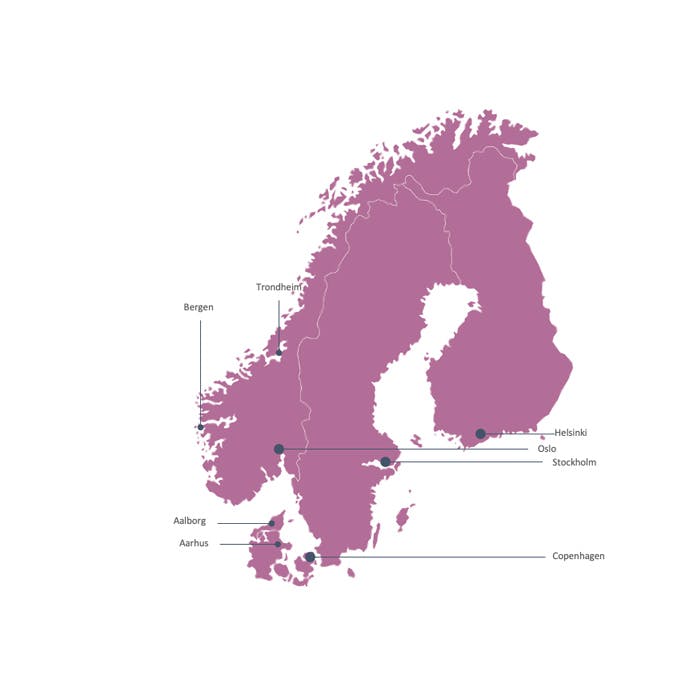

Offices in eight Nordic cities

We offer unparalleled local expertise and insights

Our presence in Sweden, Norway, Denmark, and Finland allows us to leverage deep knowledge and extensive networks for value creation in each country and throughout the region.

Investors can seize new opportunities in the Nordic market with us by their side.

Our local presence empowers us to assist you in implementing investment strategies and capturing value.

We are part of the professional real estate network, ready to support you throughout the region.

We have a wide range of services

Development

Our Development team has a commercial approach to both green- and brownfield projects, assists in the due diligence process, works closely with the authorities, and works overall with end-to-end development by providing commercial feedback and advice.

Transaction and Advisory Services

Our Transaction & Advisory Services team comprises transaction managers and analysts. Based on thorough market research and analysis, the team assists local and international investors with sourcing assets that match their investment criteria.

Investment and Asset Management

DEAS Asset Management’s tailored Nordic setup manages segregated mandates locally and also mandates with portfolios across the Nordics. We deliver investment and asset management services based on thorough knowledge of the market within various sectors and across all risk profiles (e.g. opportunistic, value-add and core).

Fund Management

Our specialised Fund Management team manages various real estate funds across the Nordics. This team is responsible for defining and implementing investment strategies and providing comprehensive oversight, in addition to the performance and providing risk management of the funds.

Commercial Foundations

We assist with developing and improving the operational economy of the foundation.

Investor Services

Through our Investor Services we offer tailored representation solutions for investors and management of interests. DEAS Asset Management has a strong track record in handling asset management for investors and with us you get professional investor representation.

Our team offers expertise in managing and optimising real estate assets

We deliver comprehensive Asset Management and Investment Management services, including Development, Transaction and Advisory Services, and Fund Management.

Integrated ESG approach

Our commitment to a responsible future

We take a large responsibility for advancing responsible development in the real estate market.

DEAS Asset Management is part of DEAS Group, a leading real estate specialist in the Nordics.

Headquartered in Copenhagen, Denmark DEAS employs 1,000+ real estate professionals and operates from eight offices across the Nordics. We are a Nordic end-to-end strategic partner that covers the entire value chain in key real estate sectors.

Management Team

Anette Grotum

Managing Director DEAS Asset Management Denmark and Head of Asset Management, Nordics. Contact on mobile: +45 2814 2828

Thomas Wollf

Managing Director DEAS Asset Management Norway and Head of Fund Management, Nordics. Contact on mobile: +47 4826 7769

Joakim Nordblad

Managing Director DEAS Asset Management Sweden. Contact on mobile: +46 7066 88041

Sanna Puhakainen

Managing Director DEAS Asset Management Finland. Contact on mobile: +358 505900599